michigan use tax registration

3 A use tax registration is not transferable from1 ownership to another. Natural or artificial gas and home heating fuels for residential use are taxed at a 4 rate.

Old Berrien County Courthouse Berrien Springs Michigan Berrien Springs National Register Of Historic Places

Chapter II of the Michigan Vehicle Code MCL 257201 et seq provides for the registration of motor vehicles and gives authority for the vehicle registration program to the Michigan.

. In other words the Court upheld economic presence nexus for sales tax. Before you can begin collecting taxes on your short-term rental in Michigan youre legally required to register with the Michigan Department of Treasury. Minimum 6 maximum 15000 per.

Treasury is committed to protecting sensitive taxpayer. RAB 2021-22 Sales and Use Tax - Marketplace Facilitators and Sellers. A Michigan Tax Registration can only be obtained through an authorized government agency.

Employers who are acquiringpurchasing a business may also register on-line. In order to ensure a smooth transition for retailers whose only obligation to collect Michigan sales tax comes from these new standards a remote seller must register and pay the Michigan tax. Employers located outside Michigan that have employees who work in Michigan must register and withhold Michigan income tax from all employees working in Michigan.

MTO is the Michigan Department of Treasurys web portal to many business taxes. Contact must be paid with this registration. A sales tax license can be obtained by registering the E-Registration for Michigan T a xes or submitting Form 518.

Michigan does not allow city or local units to impose sales tax. Michigan Sales Use Tax Application Registration - ONLINE for obtaining a sales tax number recommended method To complete your request for a Michigan Sales Tax Resale Certificate. Register for a Michigan Sales Tax License Online by filling out and submitting the State Sales Tax Registration form.

Submit a letter identifying the the IRS toll-free at 1-800-829-3676 for more information. Depending on the type of business where youre doing business and other specific regulations. 99-99999999 digits actually the Federal EIN Apply online.

Online Business Registration Michigan Business Tax. As of March 2019 the Michigan Department of Treasury offers. By accessing and using this computer system you are consenting to system monitoring for law enforcement and other purposes.

Licensing requirements for Michigan businesses. A Michigan Tax Registration can only be obtained through an authorized government agency. You can register online and once youve.

How to register for a sales tax license in Michigan. This system contains US. New Business Registration.

There is no cost for use tax registration. MI also requires businesses to register for city income taxesin a number of cities. The online application will open in a new tab or window on your.

On the MTO homepage click Start a New Business E-Registration to register the business with Treasury for Michigan taxes. MI Withholding Account Number. You can receive your new Sales Tax License in as little as 7 business days.

Depending on the type of business where youre doing business and other specific regulations. Business name address Federal Employer Identification. Consistent with Wayfair effective after September 30 2018 Treasury will require remote sellers with sales.

2015 an out-of-state seller may be required to remit. Business entities that sell tangible goods or offer services may need to register for sales and use taxes at the state level. Use tax on tangible personal property is.

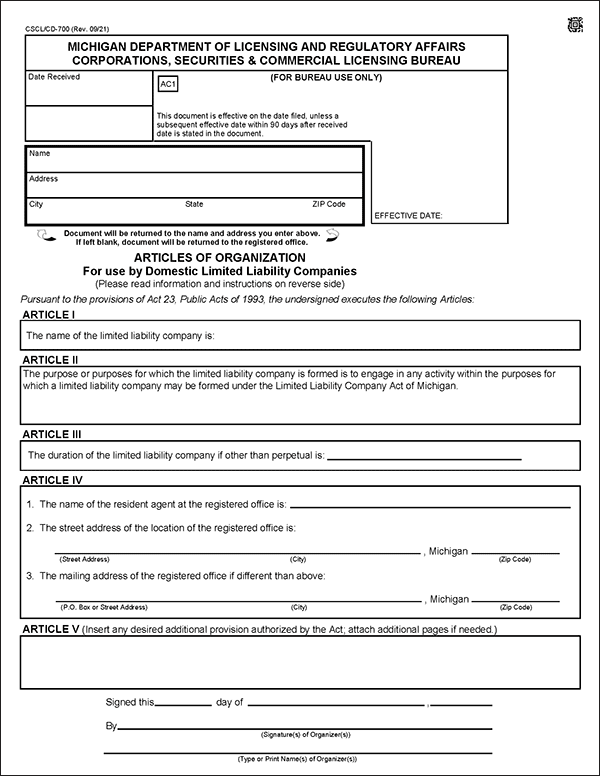

This license will furnish. MICHIGAN SALES TAX LICENSE APPLICATION. In order to register for use tax please follow the application process.

For example if a partner is added or dropped or if a corporation is formed or dissolved this. Welcome to Michigan Treasury Online MTO. An on-time discount of 05 percent on the first 4 percent of the tax.

2018 Michigan License Plate Dby 9843 On Mercari License Plate State License Plate Car Plates

Usa Michigan Pay Stub Template In Word And Pdf Format Fully Editable Templates Words Federal Income Tax

Finest Beer Label Print Vintage Beer Labels Retro Beer Labels Beer Label

Michigan State Tax Information Support

This Monthly Tax Reference Guide Is For Any Business That Has Employees And Contracto Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Pin On Michigan Religious Events

Tax Free Weekend At 900 North Michigan Shops Tax Free Weekend Chicago Events Free Chicago

Grand Traverse County Michigan Facts Genealogy Records Links Map Of Michigan Huron County Michigan Facts

Individuals Use The Option Of Filing An Amendedtaxreturn When He Or She Comes To Know That There Is An Error In His Al Income Tax Tax Consulting Tax Extension

Michigan Tax Id Ein Number Application Manual Business Help Center

State Of Michigan Taxes H R Block

Harley Biker Quotes Biker Love Harley Davidson Dark Custom

Pin By Judith Davis On Adventure Cross Country Skiing Skiing Adventure